Unless of course if not detailed, the newest views provided are the ones of your presenter otherwise writer and you may never the ones from Fidelity Investment or the affiliates. Fidelity does not guess any obligation in order to inform any of the guidance. Avoid losings requests do not ensure the execution price you are going to receive and now have more threats which can be compounded inside symptoms out of market volatility. End losses requests was as a result of rate swings and may also result in a performance really below your result in speed. Fidelity reserves the right to terminate an account any time to possess abusive trade methods and other reason.

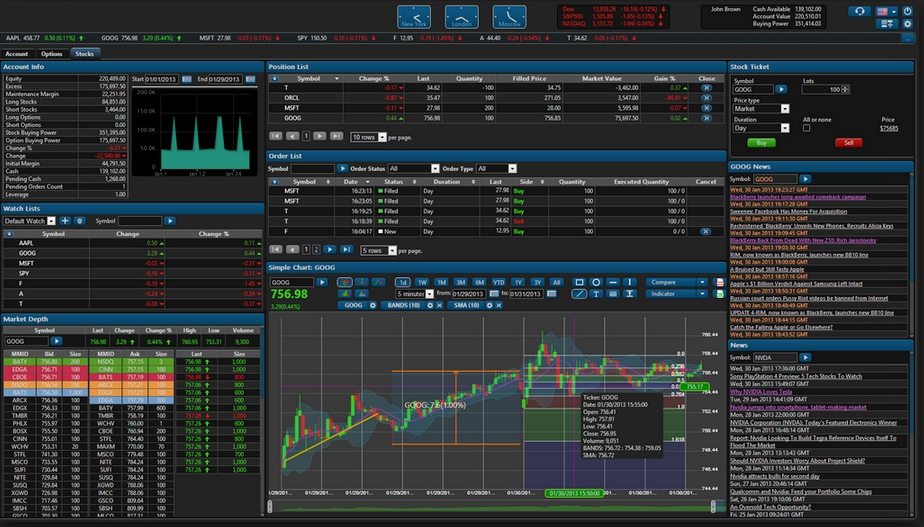

Nevertheless, it can also help in determining a security’s strength or weakness in regards to the large industry otherwise certainly one of the areas. This informative article support experts inside refining the total valuation rates because of the taking much more related analysis. Interactive Brokers (called “IBKR” or “IB”) is among the industry’s largest and most acknowledged online brokers. Punishment and you can mental fortitude are key in addition to knowledge and you may experience. You want abuse while the you might be oftentimes better off sticking to your own trading strategy should you decide face challenges.

Create I must shell out taxes for the money We secure away from stocks?

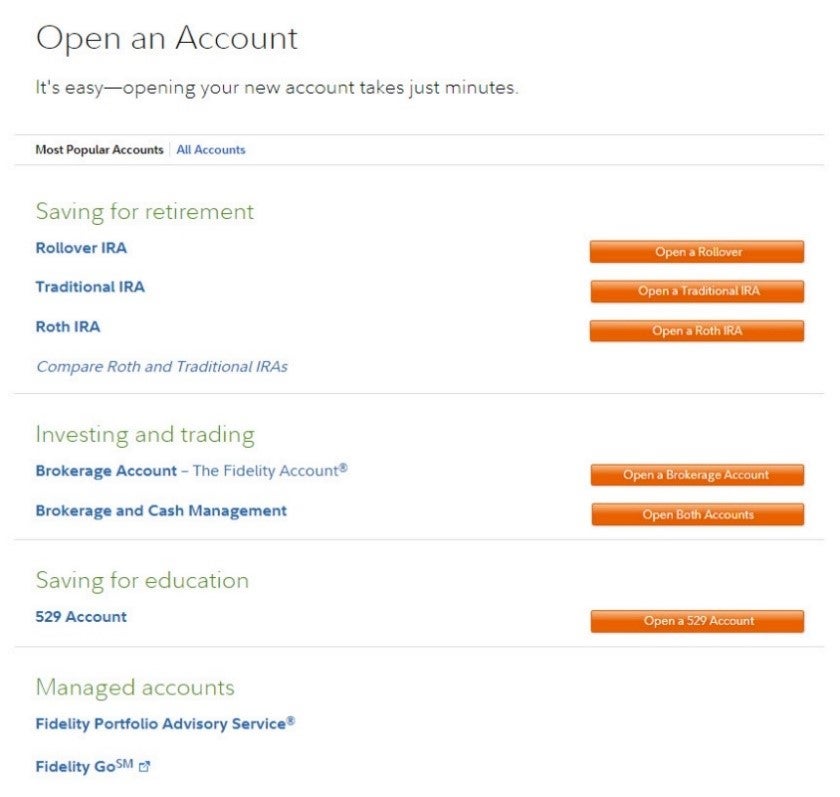

Start searching for an authorized money advisor more to the our very own sibling site, AdvisorSearch.org. Having its student-centered have, comprehensive educational offerings, and you will lowest-prices structure, Fidelity is an excellent option for the brand new traders. Go to my complete report on Fidelity to learn more about the whole providing.

Reports

An investor who investments due to a brokerage need to submit your order for the package as accomplished. The new broker is actually an intermediary which receives a purchase otherwise offer buy from a consumer, and also the purchase otherwise sell orders are following carried out once they are filled. Extremely monetary advisors choose committing to finance; especially if you have an extended date horizon, you may also put ample servings of your own collection to the inventory financing. At the same time, common finance are impractical to enhance as quickly as private equities because the unmarried-inventory investment feel the advantage one to a well-chose inventory get pay lucratively.

ETFs

These types of assets is so unstable that they must be tracked more often to quit high losings. The past element of committing to brings comes to dealing with your collection. The best way to do this will depend inside the highest region to your individuals issues discussed earlier, such as your risk tolerance, financing wants, and chosen membership type. Therefore, there’s no right way to manage and remark a portfolio.

Stock market info probably wouldn’t make you a millionaire at https://santisogarro.com/2025/09/16/pros-experts-increase-inquiries-after-trump-says-this-is-a-wonderful-day-to-help-you-buy-prior-to-pausing-tariffs/ once, but a powerful, long-identity investing approach can make you a billionaire over 2 decades. Profile diversity decrease a keen investor’s risk of permanent losses and their portfolio’s complete volatility. In return, the fresh efficiency of a good varied portfolio were less than exactly what an investor you’ll secure when they selected an individual winning inventory. Another significant investing very important are knowing the benefits of which have an excellent varied profile.

Exchange usually relates to to purchase personal brings, which is high-risk. As opposed to dispersed your money around the 10s—otherwise many—away from investment, since you you will with a common finance otherwise exchange-replaced financing (ETF), you are focusing it for the but a few businesses. Here is the calculate percentage of the investable currency that should get in stocks (as well as common fund and you may change-exchanged fund (ETFs) which might be stock-based). The others is going to be inside repaired-money assets such bonds otherwise high-produce certificates away from deposit (CDs). You may then to alter which proportion up otherwise down based on your unique exposure tolerance. Not only will a robo-advisor find your own investment, but many will also maximize your taxation results to make changes over time immediately.

Alphabet (GOOGL) shares is actually absolutely nothing altered in the premarket exchange prior to the Bing parent’s highly anticipated very first-quarter declaration after places personal now. Alphabet is anticipated in order to report an enthusiastic 11% year-over-season increase in cash which have money per display ascending so you can $2.01. Analysts are mostly bullish to the technology giant’s ability to weather financial uncertainty. The newest lookup firm shares have lost regarding the 18% of their value thus far this year. CNBC are a beginner-amicable channel, when you’re Bloomberg is based far more for the pros.

Therefore, never use your restricted finance to shop for risky holds. Earliest, you should open a broker account with an online stock brokerage. One of the largest errors of several beginning traders build are attempting to sell too soon, which can make sure they are lose out on much deeper output across the long term. Such as, whilst it would be tempting to money in after a good 10% or even 100% acquire, high companies have a tendency to continue promoting successful productivity. Contrast by using change, which could discover an investor exposure the fresh permanent loss of their financing whenever they get on the top after which surrender and sell at the bottom, securing inside losings. When you are stock market modifications will likely be problematic to own beginning traders, they tend to be small-resided.

You might protect the tough-made investment, limitation losings, and improve your exchange results from the applying effective exposure management steps. You will want to check out the holds you’re interested in prior to starting using. This requires looking at the business’s basics as well as the stock’s speed while the it moves through the years. Merging standard and you can technical study provides you with far more confidence while you are eventually diving inside.

Step two: Figure out how much can you be able to purchase

Thoroughly viewing multiple organizations in identical community brings belief for the not only the firm your’lso are trying to find as well as competitors as well as how community overall is performing. The Global World Group System (GICS) assigns per in public places traded business a market, world group, world and you may sub-world, allowing you to select and evaluate a firm and its own colleagues. If you would like the idea of give-of paying, common fund might possibly be your absolute best friend.

While you are worried about a stock altering value quickly, you can also think a threshold acquisition. Which delivers your broker to purchase otherwise sell here at a good certain rate otherwise finest. By the go out needed to lookup prospective investment, pursue change and you may fashion on the market, and apply all of the positions you desire, time trading is just as all the-sipping while the a full-day work. While you are just one organization may experience quick development and you can reward people, additionally, it may suddenly shed inside the well worth, leaving shareholders having carries worth a portion of their past speed. These types of swings could be blips for the a long-name investor’s radar, but be more extreme for short-label investors, whom can not wait the new weeks otherwise years it could take in order to win back lost worth. There’s no one-size-fits-all the means to fix that it matter since the we all have various other economic points.

Long-label exchange relates to to find offers from a friends and you can possessing him or her for an extended period, constantly 10 years if you don’t ages. The objective of long-label exchange would be to benefit from the growth of the company over time and to secure returns to your offers. Long-term purchase-and-keep buyers are usually classified much more because the people but can and become named condition people. For those who’re also playing with an agent, you’ll have to find all the investment to make change conclusion. You can invest in personal stocks or stock finance, and this generally individual hundreds of carries. A knowledgeable agents provide free research and you will a huge amount of tips on how to get holds to assist beginners.