How much cash necessary for algorithmic trading can vary drastically with respect to the method made use of, the fresh broker picked, plus the locations replaced. There are a great couple unique classes from formulas you to make an effort to identify “happenings” on the other hand. These types of “sniffing algorithms”—made use of, such, by a good offer-side field maker—have the based-inside intelligence to spot the presence of people algorithms on the purchase edge of a large purchase. Including detection as a result of formulas can assist the market founder select higher acquisition opportunities and permit these to work with by completing the brand new purchases at the a top rate.

Means Alternatives Construction

Among the types of Mathematical Arbitrage are couple trading in which i consider a ratio otherwise spread between the collection of stocks’ prices, which can be cointegrated. Should your property https://jobertabueva.com/trading-bimsen-fur-amateur-auf-diese-weise-gelingt-ein-einstieg/ value the new spread goes beyond the new expected assortment, you then purchase the stock with been down market the new inventory which includes outperformed in the assumption the spread is certainly going returning to their typical level. Analytical arbitrage can work with one hundred or maybe more brings within the its collection that are categorized based on a lot of things and can getting fully automated of each other analysis & performance perspectives.

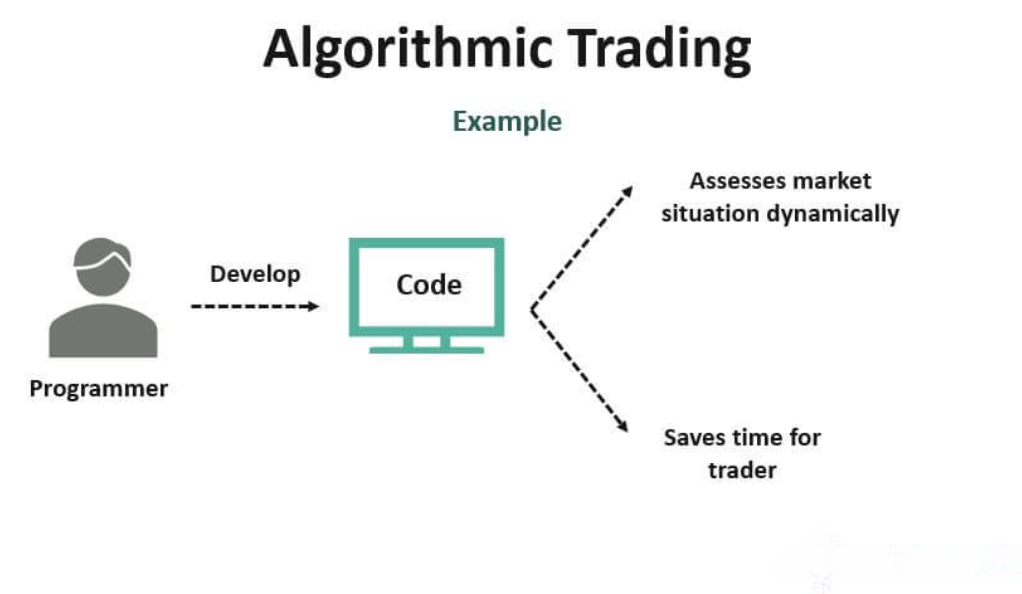

Algorithmic trading have transformed just how people approach financial segments, providing the possibility enhanced rates, precision, and you can overall performance. By utilizing the power of computer software, advanced analytical patterns, and you may APIs, algo trade lets people to help you speed up its procedures and you may capitalize on opportunities which can be hidden for the people eye. One of several potential advantages of algo exchange are its element to execute positions from the lightning-fast speed. Which price virtue is crucial inside trapping momentary rates discrepancies otherwise arbitrage possibilities. Algorithmic trade, or algo exchange, is the automatic exchanging away from bonds using pre-developed procedures. This type of algorithms explain when, exactly what, and exactly how far in order to exchange, instead of tips guide type in.

One of several significant benefits associated with algorithmic trading is the function in order to backtest procedures. From the running an algorithm as a result of historical research, people can also be choose prospective flaws and you may enhance their technique for finest efficiency. It’s the means of assessment the new algorithm and you may confirming if or not the strategy create provide the anticipated overall performance. It requires assessment the fresh designer’s means for the historical industry analysis. Simultaneously, the technique allows traders select issues that you’ll develop in case the fresh people make use of this method on the live business deals. The platform enables you to trade many places away from carries in order to crypto as well as giving decades away from historic industry analysis to have backtesting and you will a range of analysis products.

The newest coding code to own TradingView is Oak Software, and you may Microsoft C# to have NinjaTrader. Learn how OptionStation Professional may help you personalize actions which have increased precision. OptionStation Pro, section of TradeStation’s prize-effective desktop computer room, now offers an intensive platform to possess possibilities… Which topic is for informative intentions only which can be perhaps not designed getting an alternative choice to visit having a professional income tax top-notch before making any funding choices.

- The spot’s early use of AI and you will fintech innovations, along with a top intensity of trading pastime, ranks it as an international frontrunner.

- Algorithmic trading provides attained prominence while the locations become shorter and a lot more data-motivated.

- Mathematical arbitrage procedures are derived from the newest suggest reversion theory.

It’s crucial that you begin report trade before you chance real currency since it’s all also easy to more than-enhance and you will contour complement techniques to during the last, so the real sample takes place in real time industry criteria. Because of it, you can utilize a patio including TradeStation which provides report exchange that have actual-date research feeds. The brand new momentum change procedures cash in on industry shifts from the appearing at the current style in the business. As the algorithmic trading requires tricks for making the really effective choices, there are various procedures, for each based on various other field criteria. The new formula purchases shares inside Apple (AAPL) if the market pricing is below the newest 20-time moving average and you may offers Apple shares should your economy pricing is more the brand new 20-day moving mediocre. The new green arrow implies a point over the years if the formula would’ve bought shares, plus the purple arrow indicates a time in the long run when this algorithm perform’ve ended up selling offers.

Global AI Trade System Market Declaration Segmentation

This is everything about other tips based on which algorithms might be designed for change. Let’s dive higher to your progression out of change, from its manual origins on the advanced formula-dependent options i have now. For the August step one, 2012 Knight Investment Class experienced a phenomenon thing in their automatic trade system,106 ultimately causing a loss of $440 million.

The new laid out categories of instructions derive from timing, rate, quantity, otherwise people statistical model. Besides funds potential on the individual, algo-change tends to make places much more liquid and you may exchange far more clinical by the governing from the feeling away from human emotions to the exchange points. These actions take advantage of AI’s ability to get to know field study, improve trade automation, and you can do deals effortlessly inside rapidly progressing market criteria.

The new rules help get acquainted with business trend depending on the rates, assistance, opposition, frequency, and other points affecting investment behavior. Because the formulas work on technical and you may algorithm, it’s likely to be on the automatic solutions to recognize exact manner. Selecting the right algorithmic exchange application is another important thought. Programs for example TradeStation, which was effective development trading products for many years, render incorporated development environment for programming, backtesting, and you may live trade. These networks often provide business research, charting devices, and you can associations to several brokers and you can transfers thanks to APIs.

Such provide help to understand if the belief try optimistic, bearish, otherwise simple, on such basis as that your deals are performed correctly. From the performing thorough search, backtesting, and you will implementing self-disciplined exposure administration, traders can also be utilize the chance of algorithmic exchange to compliment their actions and obtain an edge inside progressive finance. Algorithmic change features transformed financial locations because of the enabling fast, effective, and you can medical exchange according to predetermined laws. Its benefits tend to be price, reliability, and you may reduced will cost you, but buyers might also want to keep in mind risks, including technical problems, regulating conformity, and you will high competition. Very first, it’s better to understand coding languages widely used in the algo trade, for example Python, Coffee, otherwise C++, and to obtain a substantial comprehension of statistical rules and you will technical analysis. So it foundational education is essential to own designing and you may assessment active trading procedures.

Money partners arbitrage is actually a method buyers used to capitalize on short-lived speed variations in the forex market. Like other algorithmic change procedures, they depends on short delivery and you may solid chance administration to succeed. Algorithmic exchange have revolutionized the new economic locations, providing people and buyers powerful systems to make usage of complex procedures, reduce costs, and you can capitalize on fleeting market potential. Because you go on their excursion for the algorithmic trading, keep in mind that achievement on earth demands a combination of coding experience, financial degree, and you will a-deep comprehension of market fictional character. Since the phony cleverness and you will host understanding tech progress, more sophisticated algorithmic change steps is growing.

You could use the strategy across 1000s of stock tickers, work with they whilst you sleep, or exchange quicker date structures (believe 1 minute) in which rates is paramount. The sole problematic area the following is you to definitely manner could possibly get fast opposite and interrupt the new energy gains, that produces this type of actions very erratic. Therefore it is most imperative to schedule the fresh purchases and you may deal accurately and prevent losings. This can be done that have compatible exposure management techniques that can safely display the new investment or take procedures to protect however, if from bad rate path.

Samples of Easy Trading Formulas

This really is less difficult than simply a conventional first pc design based because of the investigation researchers otherwise quants. Over a period of time, the necessity for a faster, a lot more reliable (without person ideas), and accurate strategy led to the beginning of algorithmic trading. Such as a swap is known as an excellent distortionary change as it distorts the market price.

But not, one of TradeStation’s best has is the combination of the proprietary program coding language, EasyLanguage. Inside procedure, industry producers purchase and sell the fresh securities out of a certain set of organizations. The field inventor works by demonstrating purchase and sell quotations for a specific number of ties. The moment your order are gotten of a purchaser, the market industry founder sells the newest offers from the individual directory and completes your order. And this, they assurances liquidity on the monetary locations that makes it easier to have people and investors to shop for and sell.